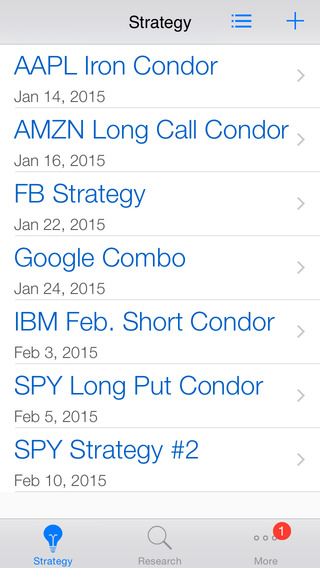

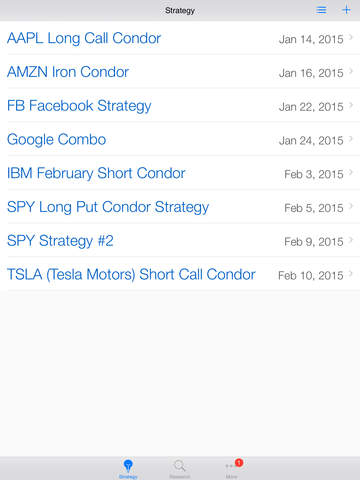

A dedicated app to help investors build, evaluate, and study various options Condor strategies easily and quickly, e.g. Iron Condor, Long Condor, etc. It comes with a highly-praised and fast loading options chain, touch based interactive profit/loss graphs, simulator of the time decay and Implied Volatility change, etc. It provides the fastest way to plan your Condor strategy. Plus, Real-Time underlying stock quotes and current Implied Volatility are included. You can further customize and manage your strategies.Condor - a limited risk, non-directional options strategy. A trader structures this strategy to earn a limited profit when the underlying security is perceived to have little volatility. A total of 4 legs are involved. There are Long Condor (with both call and put options), Short Condor (Iron Condor), Long Call Condor, Long Put Condor, Short Call Condor, and Short Put Condor. Trading options like an expert is never this easy with Condor Pro! We provide you this handy tool to draw powerful Payoff diagrams of your well planned condor strategies and calculate the profit and loss, to load near Real-Time Options Chain lightening fast, to help you become fully aware of the Implied Volatility, watch the Real-Time advanced quotes of the underlying stocks, observe the subtle difference of the spreads between bid and ask to find out the best strike you want to trade on! All you need to do is enter the underlying stock symbol and a name for your strategy, you are all set! Your condor strategy and the payoff diagram are ready for you to explore!Condor Pro offers so much convenience to help you trading options like a pro. You can even build your strategies and review / explore the Payoff Diagram when there's no internet connection! Anytime, anywhere, while traveling, on the airplane! Watch the market wisely, Plan well, and Trade smart with Condor Pro. This app is very powerful in helping you make right decisions in options trading. It helps you watch the market through visualized market information and visualize your risk/reward of the option strategy. Using the Black-Scholes model to price options, Condor Pro draws / visualizes the payoff of options strategies and clearly presents how time decay impacts strategies. Play with the IV Slider and the Date Slider to watch the impact and evaluate your strategy further more. Also enjoy the dynamic, lightening fast, near Real-Time options chains.Creating, reviewing, and sharing your options strategies are so easy! Just follow our clear on-screen guidance. You can conveniently modify the strategy according to your own needs, like edit the strike price, change the contract number, etc. With a few clicks and you are all set! Your strategies are automatically saved for further review / research. You can then study the strategy payoff diagram and observe the time decay impact through multi-touch features like pinch-to-zoom, double-touch-reset, two-finger-move, etc. Pressing one finger on the chart for a short moment, you can also bring out a magnifier for precise chart reading. Share the strategies easily by email with just one simple tap! STRATEGY --------------- ■ Unlimited strategy■ Automatically saved strategy ■ Options priced using Black-Scholes model ■ Interactive Payoff Diagram ■ Weekly Options supported ■ Current Implied Volatility ■ Dynamic Options Chain ■ Real-Time Advanced Stock Quotes including bid, ask, bid size, ask size, open, high, low, close, and volume. ■ Able to build strategy and draw Payoff Diagram Offline ■ Easy sharing of strategy. VARIOUS UNIQUE OPTIONS DATA ------------------------------------------ ■ Dynamic Options Chain ■ Weekly Options supported ■ Current Implied VolatilityDetailed background knowledge of options is not included here. You can communicate with us through the in-app message system or to appsupport@mobileinteractive.com

免費玩Iron Condor Option Strategy Profit Loss Calculator APP玩免費

免費玩Iron Condor Option Strategy Profit Loss Calculator App

| 熱門國家 | 系統支援 | 版本 | 費用 | APP評分 | 上架日期 | 更新日期 |

|---|---|---|---|---|---|---|

| 未知 | iOS App Store | 1.0.0 App下載 | $6.99 | 2015-02-13 | 2015-06-04 |